nebraska auto sales tax

The sales tax changes from state-to-state and can be increased further by the county that you are purchasing in. Free Unlimited Searches Try Now.

Nebraska only charges the.

. The Nebraska state sales and use tax rate is 55 055. Sales and Use Tax Regulation 1-02202 through 1-02204. The sales tax rate is calculated at the rate in effect at that location.

In Nebraska the flat sales tax rate is only. Ad Get Nebraska Tax Rate By Zip. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax.

In counties containing a city of the metropolitan class 18 is. Purchase of a 30-day plate by a. A vehicle that is recorded on the Purchasers Agreement which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6.

Department of Motor Vehicles. Bringing a car into America from another country can be a tricky process. Additionally city and county governments can impose local sales and use tax rates of up to 2.

The motor vehicle tax and motor vehicle fee replaced the property tax levied on motor vehicles beginning Jan. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. 31 rows Nebraska NE Sales Tax Rates by City.

The state sales tax rate in Nebraska is 5500. Here are five additional taxes and fees that go along with a vehicle purchase. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022.

Under the pre-1998 system motor vehicles were assigned a. Or Form 6XMB Amended Nebraska Sales and Use Tax Statement for Motorboat Sales. The state of NE like most other states has a sales tax on car purchases.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. If the tax district is not in a city or village 40 is allocated to the county and. With local taxes the total sales tax rate is between 5500 and 8000.

Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. Nebraska Sales Tax on Cars.

Nebraska has a state sales tax of 55 percent for retail sales. 301 Centennial Mall South PO Box 94789 Lincoln NE 68509- 4789 402 471-3918 State of Nebraska. Ad Get Nebraska Tax Rate By Zip.

Free Unlimited Searches Try Now. Vehicle Title Registration. Qualified businessprofessional use to view vehicle.

Nebraska vehicle title and registration resources. Deliveries into a Nebraska city that imposes a local sales tax are taxed at the state rate 55 plus the applicable local rate. Purchase of a 30-day plate by a.

In addition to our brief summary you should study Vehicle Importation Regulations and then contact an. Buying a car doesnt stop at the asking price. Sales tax is calculated using the percentage of the items.

A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. There is a 5 sales tax on cars in Nebraska. 49 rows Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards.

18 is allocated to the city or village except that.

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

Sales Tax On Cars And Vehicles In Nebraska

Old Illinois License Plate Tag White Blue Mk3845 Auto Garage Etsy License Plate Vintage License Plates Illinois

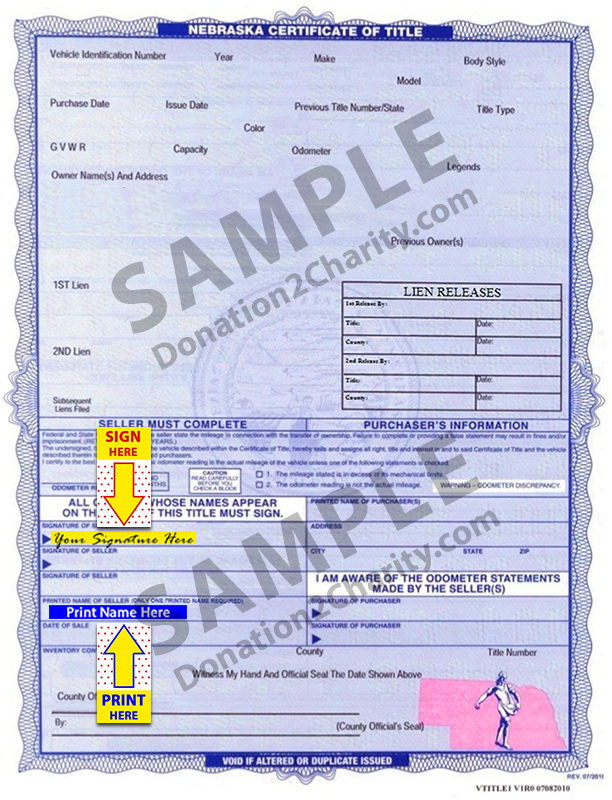

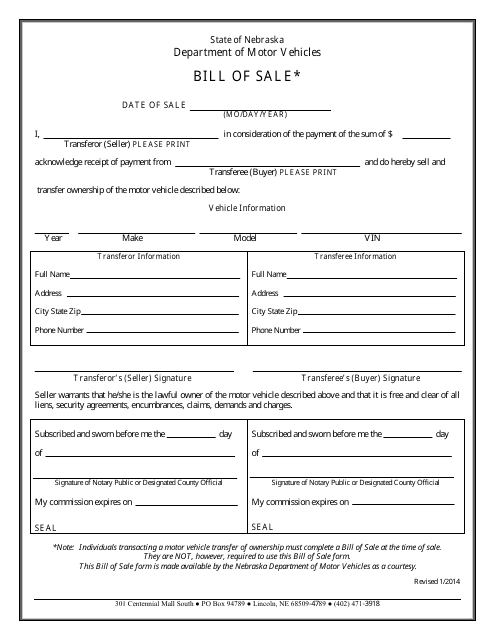

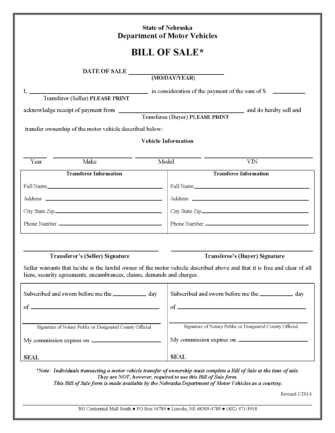

Nebraska Bill Of Sale For Vehicle Download Fillable Pdf Templateroller

2014 2022 Form Ne Parts Vehicle Bill Of Sale Fill Online Printable Fillable Blank Pdffiller

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Dodge Hellcat Redeye Used Is Dodge Hellcat Redeye Used Still Relevant Hellcat Challenger Dodge Challenger Hellcat Dodge Challenger Srt Hellcat

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

Nebraska Motor Vehicle Bill Of Sale Form Pdfsimpli

Shop Furniture Appliances Electronics Flooring Home Decor Nebraska Furniture Mart Luxury Bedding Collections Furniture Shop Nebraska Furniture Mart

Vehicle And Boat Registration Renewal Nebraska Dmv

2008 Jeep Wrangler Big Upgrades Unlimited Sahara Mods Jeep Wrangler 2008 Jeep Wrangler Jeep Wrangler For Sale

How Mhe Impacts Speed Of Fulfillment Nebraska Warehouse Material Handling Equipment Material Handling Fulfillment

Used Electric Cars Electric Cars Electricity

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Vehicle And Boat Registration Renewal Nebraska Dmv

Map Of Peony Park Vintage Beach Posters Omaha Nebraska Vintage Beach